CM Hi-Tech Farm Mechanization Financing Program 2026

The Government of Punjab has introduced the CM Hi-Tech Farm Mechanization Financing Program 2026, a major step toward revolutionizing the agricultural sector through innovation, technology, and accessibility. This initiative aims to provide interest-free financing for the purchase of modern, high-tech agricultural machinery, empowering farmers, service providers, and agri-entrepreneurs across Punjab to improve productivity and efficiency. The program focuses on enabling timely and efficient mechanized farming processes, reducing crop losses, and promoting sustainable agricultural growth.

Apna Khet Apna Rozgar Scheme The Apna Khet Apna Rozgar Scheme 2026 is a key rural development initiative launched by the Punjab Government to address unemployment and low farm income. Under the leadership of Chief Minister Maryam Nawaz Sharif, the scheme aims to turn agriculture into a reliable source of self-employment for farmers and rural…

Punjab Nigehban Ramzan Package The Punjab Nigehban Ramzan Package 2026 is a large-scale welfare initiative launched by the Punjab Government to support low-income families during the holy month of Ramzan. Rising inflation has made it difficult for many households to manage daily food expenses, especially sehri, iftar, and Eid preparations. This relief program is designed…

CM Punjab Ration Card The CM Punjab Ration Card has introduced the CM Punjab Ration Card 2026 as a major welfare initiative to support low-income households affected by rising inflation and increasing food prices. The program focuses on ensuring food security while maintaining dignity through a fully digital and transparent system. As household expenses continue…

Punjab Parwaaz Card Program The Government of Punjab has introduced the Parwaaz Card Program 2026 as a structured welfare initiative aimed at empowering young people who wish to seek employment abroad. Launched under the leadership of Chief Minister Maryam Nawaz, this program focuses on safe migration, skill readiness, and interest-free financial assistance through a fully…

Continue Reading Punjab Parwaaz Card Program 2026 How Youth Can Work Abroad Safely

WAPDA Internship Program 2026 WAPDA Internship Program 2026: The Water and Power Development Authority WAPDA has once again announced its highly anticipated Internship Program for 2026, providing a golden opportunity for fresh graduates across Pakistan. This internship aims to empower young individuals by offering practical exposure, technical learning, and professional growth within one of the…

BISP 8171 Web Portal 2026 The Government of Pakistan has taken another significant step towards transparency and ease for citizens by introducing the updated BISP 8171 Web Portal 2026. This new digital system allows eligible families to recheck their eligibility, verify payment details, and confirm the release of the Rs. 13,500 installment for November. Through…

Apni Chat Apna Ghar List 2026 Punjab Phase 2 The Punjab government has officially released the Apni Chat Apna Ghar List 2026 Phase 2, bringing hope and happiness to thousands of families waiting for financial assistance to build their own homes. Under the leadership of Chief Minister Maryam Nawaz Sharif, this program has become one…

Pak-Russia Scholarship Announced In 2026 Pak-Russia Scholarship Announced: Studying abroad is a life-changing experience, and Russia has emerged as a popular destination for international students seeking world-class education. The Russian Government Scholarship Program offers fully funded opportunities for Pakistani students to pursue Bachelor’s, Master’s, and PhD degrees. This initiative not only covers tuition fees but…

This visionary program provides interest-free loans of up to PKR 30 million for high-tech agricultural machinery, empowering farmers, entrepreneurs, and service providers to modernize their operations. By doing so, the program aims to enhance crop yield, minimize post-harvest losses, and reduce dependence on manual labor through mechanized interventions. The scheme marks a milestone in Punjab’s commitment to agricultural modernization, focusing on sustainable growth, rural empowerment, and economic stability.

Vision and Objectives of the CM Hi-Tech Farm Mechanization Financing Program 2026

The CM Hi-Tech Farm Mechanization Financing Program 2026 reflects the government’s long-term vision for transforming agriculture into a more competitive, profitable, and technology-driven sector.

The key objectives include:

- Promoting hi-tech mechanization to improve efficiency and reduce labor dependency.

- Encouraging private sector participation in agriculture through bank-financed machinery investment.

- Ensuring timely harvesting, threshing, and crop handling to minimize losses.

- Supporting farmers with interest-free credit to make advanced machinery affordable.

- Strengthening Punjab’s agricultural value chain by integrating technology at every stage of production.

By integrating modern technology, Punjab aims to close the productivity gap between traditional and mechanized farming. The program not only supports individual farmers but also service providers and agribusiness entrepreneurs who can rent out machinery and generate income, thereby creating a ripple effect of development throughout rural areas.

Overview of the Financing Scheme

At the heart of the CM Hi-Tech Farm Mechanization Financing Program 2026 lies a simple yet powerful model: provide interest-free financing through the Bank of Punjab (BOP) for eligible individuals and entities to acquire approved hi-tech agricultural machinery. Under this scheme, applicants can avail of loans up to PKR 30 million, repayable in 20 equal quarterly installments over five years, with a six-month grace period before repayments begin. The loan covers 12 different categories of agricultural machinery, both local and imported, from certified suppliers approved by the Punjab Government.

The Government of Punjab bears the entire interest cost, allowing beneficiaries to focus solely on repaying the principal amount. Each applicant contributes a minimum 20% equity share of the machinery cost, ensuring shared responsibility and financial discipline. This program bridges the gap between traditional practices and modern precision agriculture, providing financial access to cutting-edge technology that was once beyond the reach of small and medium-scale farmers.

Key Features of the CM Hi-Tech Farm Mechanization Financing Program 2026

To help applicants understand the core structure, the table below outlines the essential features of the program:

| Feature | Description |

|---|---|

| Maximum Loan Limit | PKR 30 million |

| Applicant Equity Contribution | Minimum 20% of machinery cost |

| Loan Type | Interest-free (through Bank of Punjab) |

| Eligible Applicants | Farmers, Service Providers, Entrepreneurs |

| Machinery Types | 12 categories of high-tech local & imported equipment |

| Loan Repayment Period | 5 years |

| Installment Schedule | 20 equal quarterly payments |

| Grace Period | 6 months |

| Processing Fee | PKR 5,000 |

| Interest Cost | Borne by the Government of Punjab |

These features make the program one of the most accessible and farmer-friendly financing schemes ever introduced in the province.

Eligibility Criteria For CM Hi-Tech Farm Mechanization Financing Program 2026

To maintain transparency and ensure the right beneficiaries benefit from this initiative, the program defines specific eligibility conditions. Every applicant must meet the following requirements:

- Must be a resident of Punjab Province.

- Entrepreneurs must hold a valid NTN number.

- Farmers should own at least five acres of agricultural land.

- Service providers must be registered with the Agriculture Department (Field Wing), Government of Punjab.

- Applicants must fall within the age range of 21–65 years.

- Must possess a valid CNIC and a mobile number registered in their name.

- Should have a clean credit history and no overdue loans.

- Only one application is allowed per individual or business.

- Applicants must show the ability to repay quarterly installments, assessed by the financial institution.

- Must be able to deposit the 20% equity contribution before loan disbursement.

- The beneficiary cannot sell or transfer the machinery for five years or until full repayment.

- Willingness to attend training sessions on the operation and maintenance of the machinery.

- Must agree to on-site monitoring and inspection by the Agriculture Department and Bank officials.

The criteria ensure that the program reaches genuine farmers and agri-entrepreneurs who can utilize the technology effectively and responsibly.

Benefits of the Program

The CM Hi-Tech Farm Mechanization Financing Program 2026 offers a wide range of benefits that extend beyond individual borrowers to the entire agricultural ecosystem:

- Increased productivity: Advanced machinery enables timely sowing, harvesting, and post-harvest handling, leading to better yields.

- Reduced labor dependency: Mechanization minimizes manual work, solving the chronic issue of labor shortages during peak seasons.

- Cost efficiency: Modern machines reduce operational costs and resource wastage.

- Risk reduction: Timely mechanized operations help avoid losses from weather delays or pest attacks.

- Encouragement of entrepreneurship: Service providers can rent machinery to other farmers, creating new income sources.

- Technology transfer: Local manufacturers gain exposure to global innovations, enhancing domestic capacity.

- Sustainability: Efficient machinery use leads to better resource management and lower environmental impact.

Overall, the program builds a pathway toward a more competitive and technologically advanced agricultural sector in Punjab.

Step-by-Step Online Registration Process

One of the hallmarks of the CM Hi-Tech Farm Mechanization Financing Program 2026 is its digital registration and application process, designed to ensure transparency, accessibility, and ease of use.

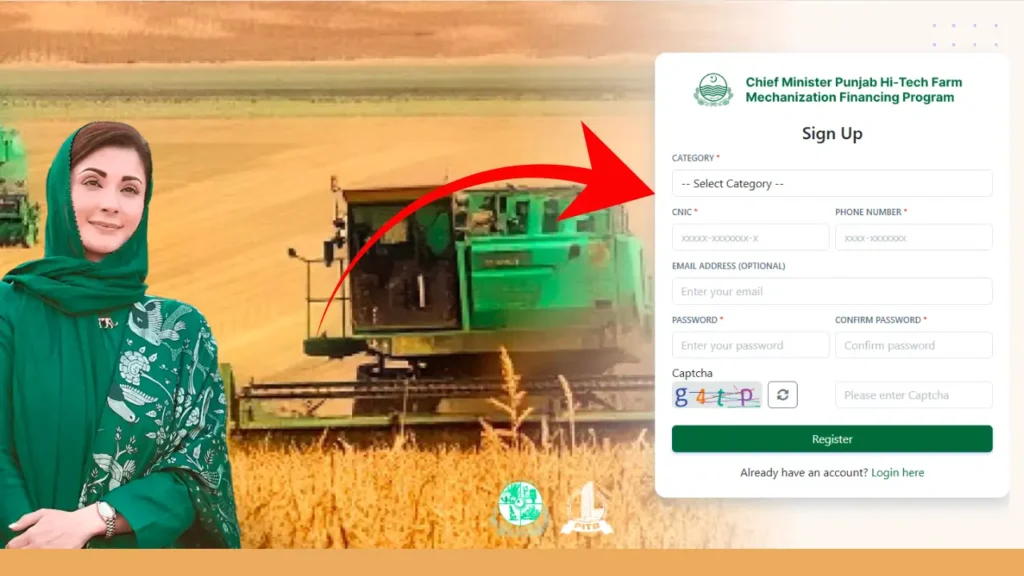

Applicants can apply through the official website cmhightech.punjab.gov.pk by following the simple steps outlined below.

Step 1: Access the Official Portal

Visit the official website and click on the “Apply Now” button displayed on the homepage. This will open the online application portal where new users can begin the registration process.

Step 2: Create a New Account

If you’re a first-time applicant, click on “Create New Account.” You’ll be prompted to fill in the initial registration details, including:

- Category selection Farmer, Service Provider, or Entrepreneur

- CNIC number in the correct format xxxxx-xxxxxxx-x

- Mobile number (should be registered in your name)

- Optional email address

- Password creation and confirmation

- Captcha code verification

Once all fields are complete, click the Submit button.

Step 3: OTP Verification

An OTP One-Time Password will be sent to your registered mobile number. Enter this code in the designated field to verify your identity. After successful verification, you’ll gain access to the detailed online application form.

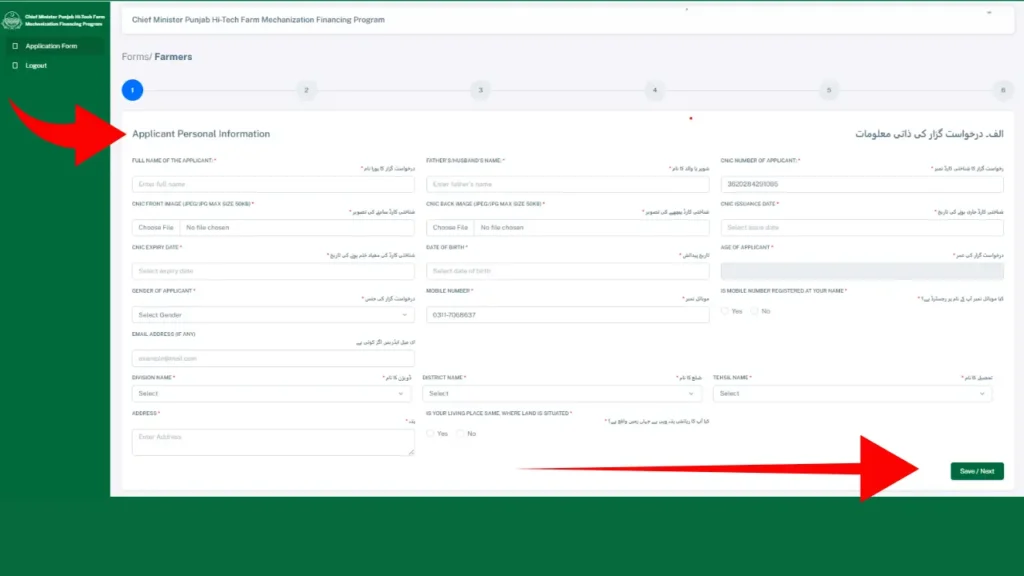

Step 4: Fill in Personal Information

In this section, applicants must provide:

- Full name

- Father’s or husband’s name

- CNIC issuance and expiry dates

- Date of birth and age (system auto-calculates)

- Gender

- Registered mobile number and email (if any)

- Residential address including division, district, and tehsil

- Confirmation if the residence and land are in the same location

Upload the front and back images of your CNIC each under 50 KB). After completing all fields, click “Save and Next.”

Step 5: Enter Family and Household Information

The next form requires details of family members, dependents, and housing status. This information helps the system assess the socio-economic profile of the applicant. Ensure accuracy, as this data may be verified later.

Step 6: Provide Land Ownership Details

Farmers must input land ownership information including the total area, location, and Fard Malkiat/Inteqal records. Upload scanned documents that verify your ownership. Service providers without land may attach alternate property collateral details.

Step 7: Witness Information

Applicants are required to enter details of a witness who can verify the authenticity of the application. This includes the witness’s name, CNIC, and contact information, along with uploaded identification documents.

Step 8: Final Review and Confirmation

After completing all the above forms, review the entire application carefully. Ensure that all details, documents, and uploads are accurate and legible. Once satisfied, click on the Confirm button to submit your application for official processing.

Upon successful submission, you will receive a confirmation message, and your application will move to the Bank of Punjab for credit assessment and further verification.

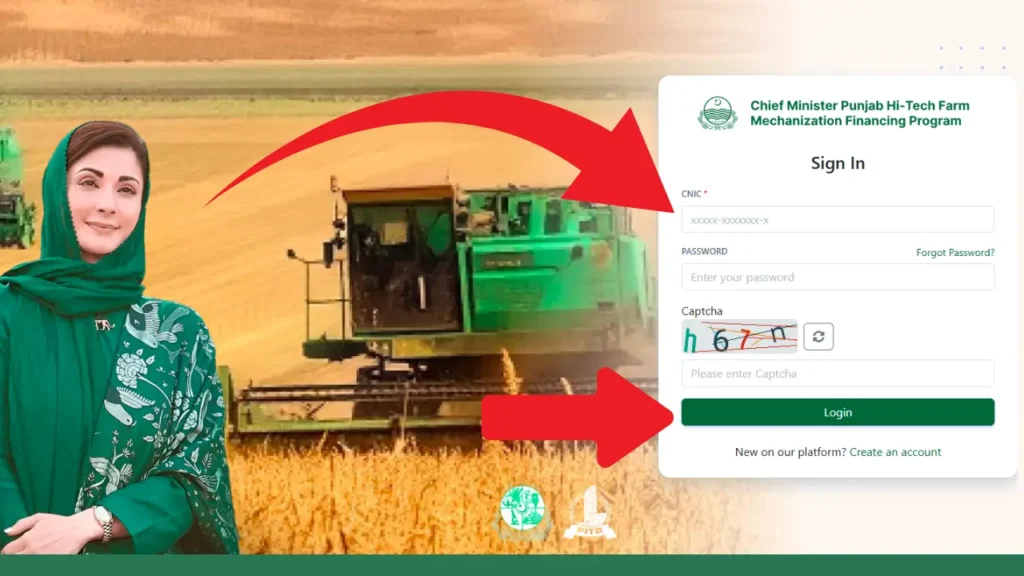

How to Check Application Status Online

You can easily track your loan or program application without visiting any office. The online portal allows applicants to stay updated anytime using their CNIC and password.

Follow these steps to log in and check your application status:

- Visit the official application portal through your web browser at cmhightech.punjab.gov.pk

- Click on the “Login” or “Applicant Sign In” option on the homepage.

- Enter your CNIC number in the required field.

- Type your password carefully in the password box.

- Click the “Login” button to access your account.

- Once logged in, go to the “Application Status” or “My Applications” section.

- Check whether your application is Under Review, Approved, or Pending Verification.

After checking, if your application is approved, you’ll receive an SMS notification and portal alert immediately. This simple online system ensures transparency, removes the need for manual paperwork, and saves your valuable time.

Loan Usage and Repayment Process

After the application submission and initial verification by the relevant authorities, the Bank of Punjab conducts a credit assessment to ensure that the applicant is financially capable of meeting repayment obligations. The loan process follows a clear, transparent system that ensures timely approval and effective fund utilization. Once approved, the bank informs the applicant about the approval status and issues an offer letter specifying the loan amount, repayment schedule, and conditions. The applicant is then required to deposit the 20% equity contribution of the total machinery cost within the specified time frame.

After the equity payment, the Bank of Punjab directly releases the approved 80% financing amount to the selected machinery supplier. This ensures that funds are used exclusively for the intended purpose — purchasing hi-tech agricultural machinery — and prevents any misuse of the loan. The beneficiary begins repayment after a grace period of six months, allowing enough time to put the machinery into productive use. The total loan is repayable in 20 equal quarterly installments over five years. These installments are fixed and designed to ensure convenience and affordability.

Important Loan Terms and Conditions

- The Government of Punjab bears the complete interest cost.

- Beneficiaries are responsible for paying only the principal loan amount in installments.

- Late payments will incur bank-specific penalties according to their schedule of charges.

- Each applicant can avail the subsidy only once during the entire project period.

- The loan can be used only for approved machinery types listed under the scheme.

This well-structured financing approach makes it possible for farmers and agri-entrepreneurs to modernize without bearing the burden of high-interest loans, which are often a major obstacle in rural financing.

Machinery Categories Available Under the Scheme

The CM Hi-Tech Farm Mechanization Financing Program 2026 covers 12 advanced types of local and imported agricultural machinery. Each piece of equipment is selected to address a specific stage of the farming process, from planting and harvesting to crop management and post-harvest operations.

- Wet Combine Harvester

- Rice Planter

- Multi-Crop Planter

- Wet Straw Baler

- Maize Cob Harvester

- Silage Harvester

- Orchid Pruner

- Orchid Air Blast Sprayer

- Nursery Machine

- Rice Harvester

- Multi-Crop Seeder

- Modern Spraying and Cutting Equipment

These machines are sourced from internationally recognized manufacturers across countries such as China, Turkey, Japan, England, the USA, Spain, Brazil, and Belarus. The inclusion of global manufacturers ensures that Punjab’s farmers receive world-class technology customized to local conditions.

Each machine is carefully tested for efficiency, durability, and adaptability to the climatic and soil conditions of Punjab, ensuring maximum utility and long-term performance.

Security Requirements and Collateral Details

To maintain accountability and ensure responsible use of public funds, beneficiaries must comply with the following security terms:

- The purchased machinery remains hypothecated to the Bank of Punjab until full repayment.

- Applicants must provide a personal guarantee.

- Comprehensive insurance coverage is mandatory, covering risks such as theft, accidents, fire, and natural calamities.

- Land ownership documents must be verified through Fard Malkiat or Inteqal.

- For service providers without land, alternative collateral such as property may be accepted.

- The applicant must have a clean financial record with Kissan Card, SBP e-CIB, and no defaults with financial institutions.

- A signed undertaking confirming the correct and productive use of machinery is mandatory.

This multi-layered approach to loan security ensures that both the government and beneficiaries remain committed to responsible financial management.

Approved Suppliers under the Program

The success of this initiative also depends on reliable suppliers who provide quality machinery and after-sales support. The Punjab Government has partnered with leading agricultural equipment suppliers who meet strict performance, quality, and service criteria.

Below is the list of approved suppliers:

- Al-Inayat & Sons

- Aliz International & Solgro (Consortium)

- Bashir Trading Corporation

- BMITCO (Pvt) Ltd

- Buraq Tractor (Pvt) Ltd

- Circle International Trading Company

- Crosfield Agro

- Dawood Agro Company

- Farm Dynamics Pakistan (Pvt) Ltd

- Fecto Belarus Tractors (Pvt) Ltd

- Guard Agricultural Research & Services (Pvt) Ltd

- Haji Sons International

- Hitec Technological Concern (Pvt) Ltd

- Jaffer Agro Service (Pvt) Ltd

- Jaffer Brothers (Pvt) Ltd

- Japan Machinery Store

- Khan & Sons JV Agroten Traders

- Margalla Heavy Industries Ltd

- Meskay & Femtee Trading Company (Pvt) Ltd

- Millat Tractors Ltd

- Pak Tractor Manufacturing Company (Pvt) Ltd

- Ravi Automobile (Pvt) Ltd

- Zoomlion Pakistan (Pvt) Ltd

These suppliers represent the backbone of the mechanization drive, ensuring that every beneficiary receives high-quality machinery backed by training, maintenance, and technical support. Farmers can select machinery from any of these approved vendors after loan approval.

Monitoring and Post-Loan Supervision

To maintain accountability and ensure that machinery is used for agricultural purposes, the Agriculture Department and the Bank of Punjab conduct periodic inspections.

Officers visit the beneficiary’s farm to verify:

- Proper use of machinery for agricultural or service-provision purposes.

- Adherence to the repayment schedule.

- Condition and maintenance of machinery.

- Compliance with non-transfer and non-sale clauses.

This ongoing supervision not only maintains transparency but also builds trust among future applicants. The field monitoring team also collects feedback from users, which helps the government improve future programs.

How to Get Help or Support

For applicants who face difficulties during registration or loan processing, the government provides a dedicated helpline and support service.

Applicants can call 0800-17000 for assistance related to:

- Registration issues

- Application submission queries

- OTP or login errors

- Eligibility clarifications

- Documentation guidance

- Bank-related inquiries

The helpline operates during working hours, connecting applicants directly with trained representatives who can provide step-by-step assistance. Additionally, applicants can also reach out through local Agriculture Department offices for physical guidance or document verification.

This direct support mechanism ensures that every farmer and entrepreneur, even in remote areas, can complete their application successfully and benefit from the scheme.

Program Impact and Long-Term Vision

The CM Hi-Tech Farm Mechanization Financing Program 2026 represents a major stride toward agricultural transformation. By introducing modern technology through affordable financing, the initiative addresses long-standing challenges faced by Punjab’s agricultural sector.

Economic Impact

- Boosts agricultural productivity and profitability.

- Creates new business opportunities for machinery rental service providers.

- Reduces dependency on imported grains by enhancing local production.

- Encourages private sector participation and investment.

Social Impact

- Improves the living standards of rural communities.

- Reduces manual labor burden, particularly for women and older farmers.

- Generates employment through service centers and machinery workshops.

Environmental Impact

- Promotes sustainable use of water and soil resources through precision agriculture.

- Reduces waste and emissions by enabling timely field operations.

- Supports climate-resilient farming practices through technology adoption.

This program is more than just a loan initiative; it is a foundation for Punjab’s long-term agricultural sustainability and food security.

Future Expansion of the Scheme

The Punjab Government plans to expand the scope of the program in future phases by:

- Increasing the list of approved hi-tech machinery.

- Adding more participating financial institutions.

- Integrating smart monitoring systems for efficiency tracking.

- Providing digital literacy and machinery maintenance training to farmers.

Such initiatives will ensure that Punjab remains at the forefront of agricultural innovation in South Asia.

FAQs Of CM Hi-Tech Farm Mechanization Financing Program 2026

What is the CM Hi-Tech Farm Mechanization Financing Program 2026?

It is a government initiative providing interest-free loans up to PKR 30 million for purchasing hi-tech agricultural machinery to promote mechanization and productivity.

Who is eligible to apply for this program?

Farmers, service providers, and agri-entrepreneurs residing in Punjab who meet the land, age, and registration requirements are eligible.

What is the maximum loan amount offered?

Applicants can receive an interest-free loan of up to PKR 30 million, depending on the machinery type and project proposal.

How much equity contribution is required?

Applicants must deposit at least 20% of the machinery cost as their equity share before the loan is disbursed.

Which bank is responsible for loan processing?

The Bank of Punjab (BOP) handles all financial processing, verification, and repayment schedules under this program.

What types of machinery are included in the CM Hi-Tech Farm Mechanization Financing Program 2026?

The scheme covers 12 types of high-tech agricultural machinery such as rice planters, silage harvesters, and wet combine harvesters.

How can I apply online?

You can register through cmhightech.punjab.gov.pk, create an account, fill out forms, upload documents, and confirm your application digitally.

What happens after I submit the application?

Your application is reviewed by the Agriculture Department and then forwarded to the Bank of Punjab for credit assessment and approval.

How long is the repayment period?

The repayment period is five years, divided into 20 equal quarterly installments, with a six-month grace period.

What happens if I miss an installment?

Late payments incur additional charges according to the Bank of Punjab’s policy. Continuous defaults may affect future eligibility.

Can I apply again if I already received a subsidy?

No. Each eligible applicant can benefit from the subsidy only once during the entire project period.

Can the machinery be sold or transferred?

No, the machinery cannot be sold, transferred, or mortgaged for five years or until full repayment of the financed amount.

Are there training sessions available?

Yes, beneficiaries must attend training sessions on the proper use and maintenance of machinery to ensure efficiency and safety.

How can I get support if I face problems during registration?

You can contact the official helpline at 0800-17000 or visit your nearest Agriculture Department office for guidance.

What documents are required for the application?

Applicants need CNIC, land ownership documents, NTN (for entrepreneurs), and witness details with ID proof.

Can service providers without land apply?

Yes, they can apply if they are registered with the Agriculture Department and can offer alternate collateral.

How are suppliers selected under the CM Hi-Tech Farm Mechanization Financing Program 2026?

All suppliers are vetted and approved by the Punjab Government based on quality, service, and compliance with standards.

How will I know my application status?

You can log in to your account on the official portal using your CNIC and password to check real-time updates.

Who bears the interest cost of the loan?

The Government of Punjab pays the entire interest cost, making the loan completely interest-free for beneficiaries.

What if I need technical support after purchasing machinery?

Approved suppliers provide after-sales support, maintenance, and technical guidance to ensure the best machinery performance.

Final Words Of CM Hi-Tech Farm Mechanization Financing Program 2026

The CM Hi-Tech Farm Mechanization Financing Program 2026 represents a monumental step toward revolutionizing Punjab’s agricultural landscape. By merging financial accessibility with technological innovation, the program empowers farmers and agri-entrepreneurs to adopt modern methods, reduce operational costs, and boost production.

This initiative not only enhances the livelihood of individual farmers but also contributes to the broader goals of food security, rural development, and economic growth. The Government of Punjab’s forward-thinking approach ensures that the agriculture sector remains sustainable, competitive, and ready to meet future challenges.